Leading Security Standards

We implement best-practice security measures, which include frequent audits, bug bounty programs, economic risk assessment, incident response planning, and real-time monitoring.

Experienced Leadership

Our leadership team possesses extensive experience from prominent institutions such as

with Kinza Native BTCLRT kBTC

Secure Money Market

High-Level Security

Kinza Finance prioritizes security with innovative security features. Asset Isolation insulates volatile assets from stable assets to avoid contagion. Protected Collateral allows users to protect their capital from borrowers.

Next Gen Capital Efficiency: LRTs

Liquid Restaking Tokens (LRTs) free up Ethereum and POS chain staker' capital. Kinza Finance continues to expand and support the widest selection of LRTs with deep liquidity and boosted yield.

Real Yield

We align token emissions with fees generated using a unique veTokenomics model called ve-Real-Yield. Users can stake the native Kinza token KZA to direct future token emissions, and collect fees and bribes.

BTC LRT

Unlocking Trillions

Bitcoin staking taps 21 Million Bitcoin, unlocking trillions of capital to secure Proof of Stake chains, and stimulating yield for BTC hodlers. Kinza native BTC LRT kBTC, powered by Babylon, frees up BTC staker capital and serves as a frictionless portal into the DeFi lanscape for BTC stakers supported by Kinza Finance liquidity.

HODL 2.0

With Kinza Bitcoin staking, experience next level capital efficiency to elevate your HODL, freeing up your capital to lend, borrow, and invest. Simply connect your bitcoin and EVM wallet, stake BTC, and recieve kBTC 1:1 on your preffered network. Unstake at your convenience back to BTC.

ModularPermission Lending

Kinza Finance is working on a new generation of lending platform that's modular and permissionless. It allows users to curate particular lending maps by designating which assets can be used as collateral against deposit, or simply join an existing pool maintained by experienced curators. Kinza ModuLend brings transparent and automated risk management for the most flexible DeFi strategies.

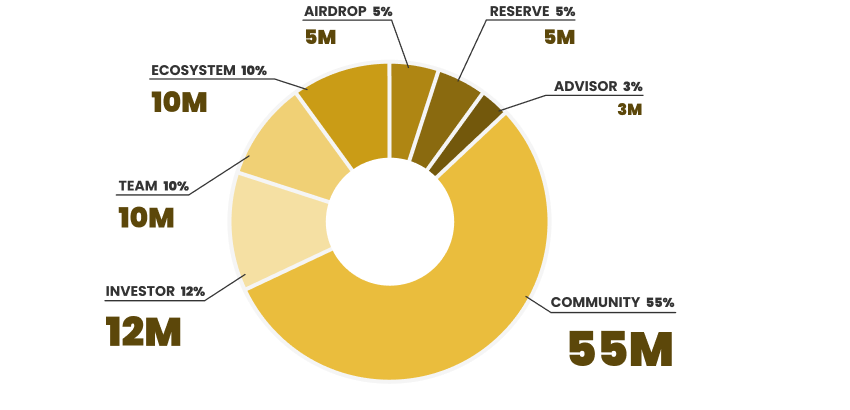

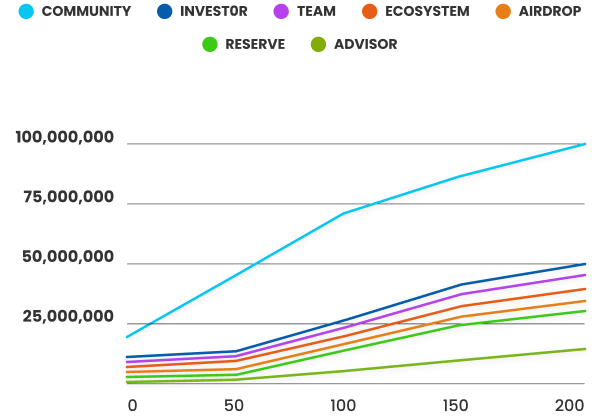

KZA Token

Token launch date not yet announced. Deposit right now to earn airdrop!